The Pay-Later Power Play: See How Delayed HSA Reimbursements Can Fuel Your Growth

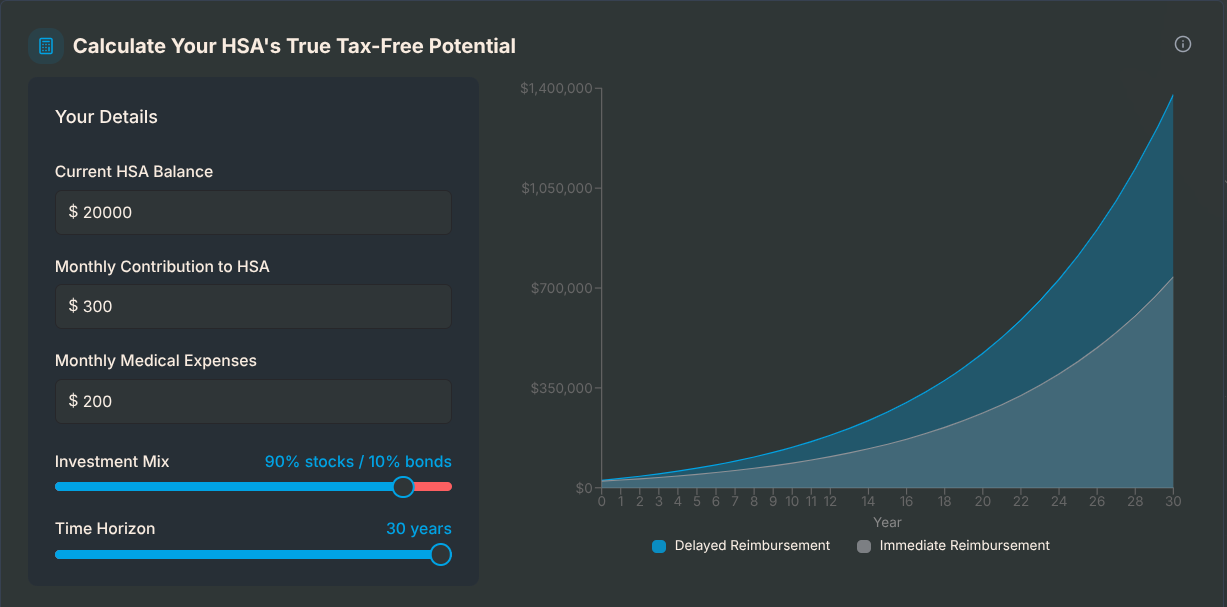

Don't just spend from your HSA—strategize with it. Our new calculator shows you the powerful financial impact of paying for today's medical expenses out-of-pocket to let your HSA investments grow, tax-free, for decades.

Every HSA optimizer knows the strategy: pay for medical expenses out-of-pocket today, keep meticulous records, and let your HSA investments compound tax-free for years, or even decades. The plan is to reimburse yourself from that much larger, tax-free balance in the future.

It’s a powerful concept. But the actual financial impact can feel abstract. What does that growth truly look like? How much of an advantage are you creating by waiting five, ten, or twenty years to reimburse yourself?

This uncertainty is a barrier. To confidently execute a delayed reimbursement strategy, you need to see the payoff.

From Strategy to Tangible Wealth

We built the hsa_stack Growth Calculator to eliminate that ambiguity.

In under a minute, our interactive tool allows you to model exactly how a delayed reimbursement strategy can amplify your wealth. See the tangible difference between spending your HSA funds today versus letting them grow untouched while you pay for expenses out-of-pocket.

The calculator makes it simple to visualize your future, tax-free nest egg by letting you adjust for:

- Initial & Ongoing Contributions

- Potential Investment Returns

- Your Personal Time Horizon

Seeing your $50,000 HSA balance blossom into a million dollar asset provides the confidence needed to stay the course. It transforms the "delayed reimbursement" idea from a clever hack into a core pillar of your financial plan.

Stop wondering about the potential. See it, plan for it, and build toward it.

Ready to see your strategy's potential?