The Delayed Reimbursement Strategy: How to Turn Your HSA Into a Tax-Free Growth Engine

The Health Savings Account is more than just a way to pay for today's medical bills. It's a triple tax-advantaged investment vehicle. The key to unlocking its full potential is the delayed reimbursement strategy, and executing that strategy requires a tool built for the job.

Are you getting the most out of your Health Savings Account (HSA)? For many, it’s a great way to pay for today's medical bills, but its true potential is far greater.

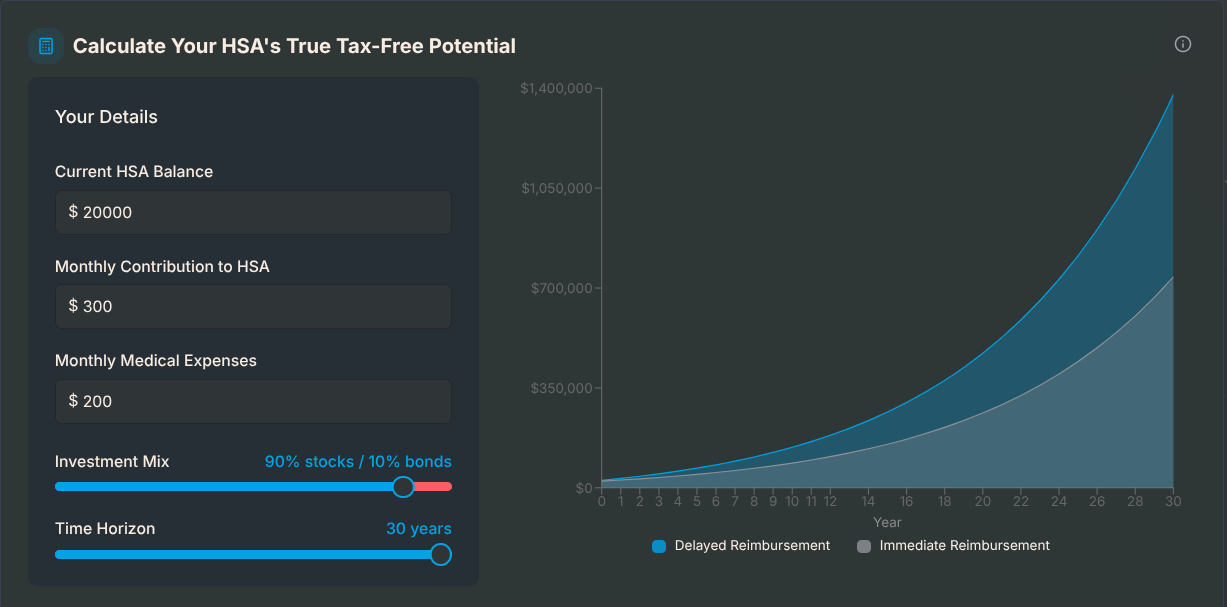

The real power of an HSA isn’t just its tax-deductible contributions and tax-free spending on qualified medical expenses. The third, and most potent, advantage is tax-free growth. When managed correctly, your HSA can become one of the most powerful investment accounts you own, rivaling—and in some ways, surpassing—your 401(k) or IRA.

The key to unlocking this potential is a powerful strategy called the Delayed Reimbursement Strategy.

The Strategy: Pay Now, Grow, Reimburse Later

The concept is simple but profound:

- Pay for today’s qualified medical expenses (QMEs) with a post-tax credit card or cash, not your HSA debit card.

- Meticulously save every single receipt for those QMEs.

- Keep the money inside your HSA invested, allowing it to grow completely tax-free for years, or even decades.

- Years later, when you need cash for any reason—a down payment, a new car, or supplemental retirement income—you can reimburse yourself from your HSA, tax-free, using the bank of receipts you’ve accumulated.

Every dollar you spend on a QME out-of-pocket becomes the basis for a future tax-free withdrawal. You are effectively creating a “tax-free emergency fund” that grows alongside your investments.

The Problem: The Strategy is a Nightmare on Spreadsheets

This strategy is brilliant in theory, but the execution can be a burden. Manually tracking every expense across spreadsheets and cloud drives is tedious and stressful. The biggest challenges are:

- Disorganization: Keeping decades of receipts perfectly organized, categorized, and accessible is a significant chore. A lost receipt is lost money.

- Audit Anxiety: The IRS can inquire about your expenses. The fear of not having unimpeachable, audit-ready records for a reimbursement you take 20 years from now is real.

- The Reimbursement Puzzle: When you need to pull, say, $5,000, you face the manual, frustrating task of sorting through hundreds of receipts to find a combination that adds up to your desired amount.

These hurdles prevent most people from even attempting the strategy. It requires a system. It requires a tool engineered for the job.

The Solution: hsa_stack Streamlines the Process

hsa_stack is built from the ground up to help you execute the Delayed Reimbursement Strategy. It transforms the administrative burden into a more streamlined, automated process.

- Simplified Capture and Classification: Forget the spreadsheet. hsa_stack makes capturing receipts much easier. You can upload receipts from your computer or connect your Google Drive and Dropbox accounts. Our AI-powered system extracts the key data like provider, date, and amount, and queues it for your one-click approval. You save hours while maintaining complete control.

- Achieve Audit-Proof Confidence: We built our platform on the principle of unwavering trust and security. hsa_stack creates an organized, immutable record of your qualified expenses. If you ever need it, you can generate comprehensive audit documentation, giving you tangible peace of mind and eliminating compliance anxiety.

- Execute with Smart Reimbursement: This is where the magic happens. Ready to reimburse? Instead of spending hours puzzling over a spreadsheet, just tell hsa_stack the amount you need. OurSmart Reimbursement algorithm instantly finds the optimal batch of eligible receipts to match your target amount. What used to be a headache is now a simple, intelligent action.

- Maintain a Closed Loop: To ensure your records are always pristine, hsa_stack links everything together. Once a reimbursement is created, the associated receipts are automatically marked as "reimbursed" to prevent double-dipping. Through our Plaid integration or manual entry, you can then link the actual distribution from your HSA provider directly to the reimbursement record in hsa_stack, creating a perfect, closed-loop audit trail.

Stop Tracking. Start Engineering.

Your HSA is a wealth-building engine waiting to be ignited. The Delayed Reimbursement Strategy is the fuel, and hsa_stack is the key.

Stop wrestling with disorganized receipts and start engineering your financial future.